Surrogacy insurance is vital for a great number of intended parents who are passionate about doing this procedure. For most parents, it’s a costly process, and they are interested in finding a suitable way to cut the expense as well as that the quality of the process never changes. One way is Surrogacy insurance. The main point of this article is to find a cost-effective way to ease the parent’s minds about the cost of a surrogacy journey. Tow different ways will be analyzed: surrogacy insurance coverage and travel to another country.

What do you know about surrogacy insurance?

Surrogacy insurance coverage is different from one country to another. insurance policies covered all pregnancies Before surrogacy was introduced, and people find information about it. After that, insurance rules changed. Nowadays, countries don’t have any specific rule regarding surrogacy. On top of that, we should consider that insurance coverage differs when it comes to intended parents and surrogates. Before any further moving, you should be aware of the rules and insurance coverage. If you have a contract with a surrogacy agency, they will help you in this matter. Surrogacy professionals will review each party’s insurance policies to determine what costs will be covered and then estimate what services may be covered by supplemental insurance and how much the intended parents will be expected to pay for medical expenses. Generally, the surrogacy medical process includes two aspects that may be covered by insurance: infertility treatments and surrogate pregnancy.

Do I need insurance for a surrogate?

Surrogates need insurance coverage during a surrogate pregnancy. The types of insurance required in a surrogacy journey include:

- Complications insurance

- Life insurance

- Maternity insurance

- Back up to maternity coverage

When the baby is born, the baby ought to be covered by insurance. Intended parents have a chance to add their newborn to their existing health insurance policies.

Why don’t some insurance companies cover surrogacy?

At first, every kind of pregnancy was covered by insurance companies no matter who the mother was. By this, I mean surrogacy medical expenses were covered. But after surrogacy gained popularity among infertile spouses, this procedure has lost insurance coverage. These days, surrogacy is covered by some insurance companies as an additional coverage option, and some companies have another way. Overall, people are beginning to realize that the surrogacy journey is not regarded as an essential procedure by insurance companies as well as cosmetic surgery and mental health care. No matter how vital these processes are for people and can revolutionize their life.

What does partial coverage mean?

“partial” coverage is an option which is offered by Some insurance companies for surrogacy and infertility expenses. In this situation, part of costs will be covered, but not all of them. For instance, they cover pregnancy, but postnatal and delivery are not included. Partial can also mean that insurance provider will cover infertility treatments, but not anything related to surrogacy journey. For example, IVF and IUI are protected, but that does not always extend to the surrogate’s pregnancy.

What is or is not covered by surrogacy insurance

- Embryo transfer to a surrogate cost will not be covered by insurance companies. The price of donated eggs will not be coved as well. All these processes should be done by parents.

- Some insurance providers, in some circumstances, cover in vitro fertilization procedures. They have limited resources in this area, and some will cover IVF procedures as part of an infertility benefit.

- While Some insurance companies which cover pregnancy exclude medical coverage for surrogate pregnancies, according to the law, they should cover the process of traditional pregnancy. It is their responsibility. But intended parents are in charge of protecting the fertility treatments or the donor.

The surrogate’s insurance provider

If The surrogate has medical coverage, it would be perfect, as insurance will cover part of the service and process of pregnancy. But her medical insurance might not cover surrogate pregnancies. In this case, the intended parents should purchase a backup plan or a new plan for surrogacy. Some insurance plans cover surrogacy, but part of it includes surrogate maternity coverage.

Surrogacy insurance for the Newborn

When the baby is born, is not covered by the surrogate insurance, and from this moment intended parents should take action, and they are responsible for providing insurance coverage for the baby. Intended parents usually have health insurance which can be easily expanded to cover a new family member. In this situation, the baby will be covered by medical insurance without any difficulties. If a baby has any problems, for example, being immature or some diseases, the cost of treatment is on the biological parents. If parents have private insurance, the newborn should be added in their insurance coverage, before the baby is born for unexpected problems.

How much does surrogacy insurance cost?

As far as surrogacy is concerned, it is essential to know that it is one of the most expensive processes among infertility treatments. Insurance can play a vital role in all parts of it, from finding a suitable surrogate to delivery. If the surrogate’s insurance plan does not cover the surrogacy, it would be a problematic issue. Some private insurance can cover that, which is sometimes expensive but compared to the cost of all journey, it is cost-effective and it is highly recommended.

Surrogacy insurance in the USA

Surrogacy is legal in most states in the USA, and some insurance exists for this journey. When women are carrying their pregnancy, they’re able to use their medical insurance. However, surrogates can make this process a bit trickier, as policies and coverage vary across insurance providers. Before taking any action in the USA you should be aware of surrogate insurance coverage. Sometimes insurance providers exclude surrogate pregnancies from their coverage plans. Specific clauses would mean that the surrogate’s insurance provider won’t cover costs associated with surrogacy.

Surrogacy insurance in Canada

Canada is one of the countries that has approved the surrogacy journey, and this valuable process is legal in Canada. But just altruistic surrogacy. It means a surrogate isn’t allowed to take money for caring for the baby. Needless to say, insurance companies from other countries don’t cover the surrogacy cost in Canada.

Surrogacy insurance in India

According to the Surrogacy Regulation in India intended parents supposed to provide health insurance for surrogates for 36 months. This insurance must include all the pregnancy health cares and any other possible problem regarding pregnancy. In case of emergency, the surrogate is allowed to terminate the pregnancy by a doctor’s advice.

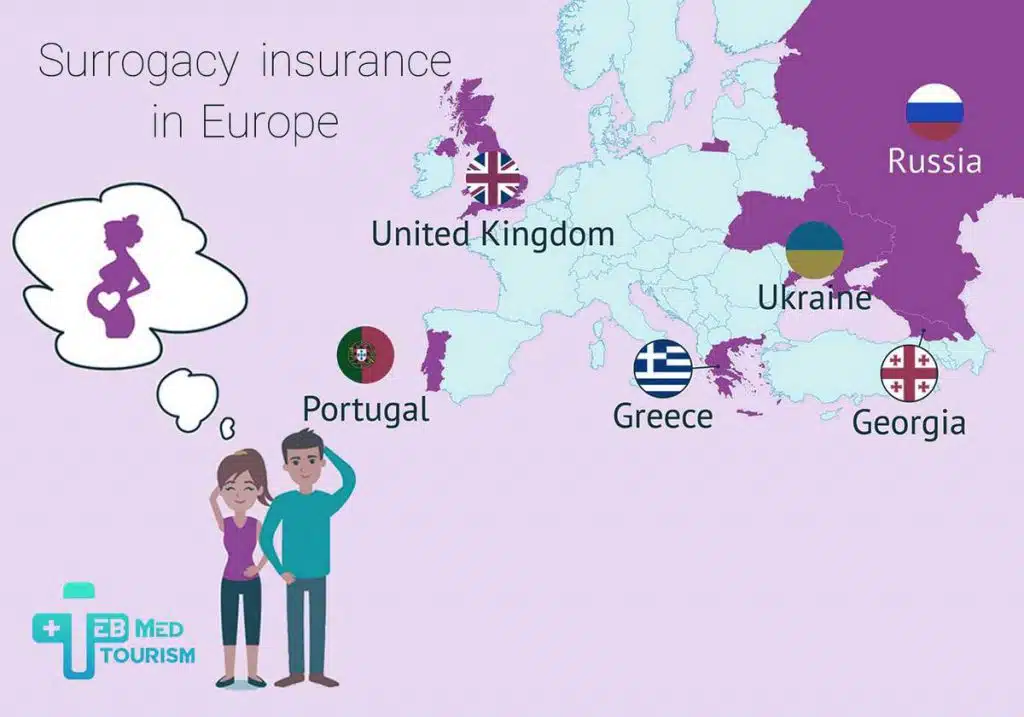

Surrogacy insurance in Europe

Owing to the fact that surrogacy is considered illegal in most of Europe such as Italy, Spain, France, and Germany surrogacy insurance is meaningless in this part of the world. In the UK, surrogacy is legal just for UK residents. In Ireland, the Netherlands, Belgium, and the Czech Republic there is no law regarding surrogacy and it can’t be done in these countries. Ukraine is open to any kind of surrogacy for residents and foreigners. But there is no insurance for people from abroad.

Surrogacy insurance in turkey

Surrogacy is rated as an illegal act in turkey. Being a surrogate has punishment as well. However, Turkey citizens are allowed to go to other countries for having babies in this way.

Surrogacy insurance in Russia

Although the surrogacy journey has been done in Russia for years, this country is about to ban surrogacy for foreigners and of course, there is no surrogacy insurance in Russia for people from outside.

Surrogacy insurance in Iran

As mentioned, surrogacy insurance coverage varies from one country to another, and some countries consider this practice illegal; as a result, there is no insurance coverage for this valuable and effective procedure. While even some developed countries don’t approve of surrogacy, it is a legal practice in Iran. This country is one of the pioneers in using this kind of infertility treatment for those parents who wish to have their lovely child. Of course, there is some insurance for Iranian residents. If you are willing to have a baby by this method in Iran, keep in mind that even if you have surrogacy insurance coverage in your country, insurance companies don’t cover the surrogacy journey in another country. If you plan to do this procedure in Iran, you should know that your country’s insurance is no longer adequate. you might be wondering, given this disadvantage, why should you? make a surrogacy journey in Iran. However, it should be noted that the cost of surrogacy in Iran is much lower than in other countries. Even by applying for insurance coverage in your country, you will save money by doing this procedure in Iran. The cost of a surrogacy journey in Iran will be around 21,000 to 36,000$, while the cost of this treatment will be roughly 140k$ in the USA. So, it’s an affordable process for the majority of parents, and Iran is considered the cheapest country for surrogacy procedures. In addition, finding a suitable surrogate is not an easy task, and it is time-consuming. A variety of factors should be taken into account when it comes to choose surrogate mother, and the process should be done professionally and by experts. One of the incredible advantages of the surrogacy journey in Iran is that the surrogates have been prepared, and they are ready to start the process. Doing this procedure in Iran is not only cost-effective but also helps you to save time. It is vital to mention that the teb med tourism company is regarded as one of the leading companies for infertility treatment specially surrogacy journeys not only in Iran but also in the whole world. people from around the world can come here for all the processes since this center is known for high quality and highly efficient services.

Surrogacy insurance and guarantees in Iran

Another advantage of a surrogacy journey in Iran, and especially the Tebmedtourism companies is that some parents are given a 100% guarantee after the initial review of their cases. This guarantee means that the intended parents will absolutely have a child through this process, no matter how difficult it is and how many times the surrogacy agency is supposed to do the IVF and transfer the embryo to the surrogate uterus. In case of failure the first time, these measures will be carried out again and again until the parents have a child. There is no such guarantee in other countries and other companies. This is a critical effort for pleasing parents and making them confident. Moreover, it is possible to transfer embryos, sperm, and eggs from all countries to Iran. So, the presence of parents in Iran for all the processes is unnecessary. The transfer will be done by specific international companies, the embryo can be transferred to Iran, and surrogacy can be performed. Surrogate is available in Iran, and the surrogacy journey will be done in the shortest period. The process is carried out in Iran until the delivery, after which the baby is handed over